15 Sep CBN TO Establish International Financial Centre

The Central Bank of Nigeria (CBN) is to establish the Nigerian International Financial Centre (NIFC).

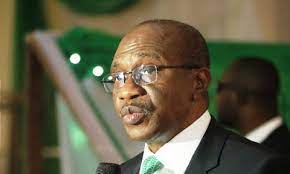

CBN Governor, Godwin Emefiele who made this known at the 14th Annual Banking & Finance Conference, being organized by the Chartered Institute of Bankers of Nigeria (CIBN) on Tuesday, said the NIFC will act as an international gateway for capital and investments, driven by technology and payment system infrastructure.

Speaking on the theme of the Conference “Recovery, Inclusion and Transformation: The role of Banking and Finance”, the CBN governor in his keynote address explained that the new financial hub will curate local and international banks to make them global champions.

“The NIFC will be a 24/7 Financial centre that will complement London, New York and Singapore financial centers and enable an acceleration of our home grown initiatives such as the Infracorp plc, the N15 Trillion infrastructure fund which we will be launching in October 2021”, he said

The NIFC, according to Emefiele, will also complement ongoing initiatives on the Nigerian Commodity exchange and the National Theatre creative hubs Nigerian youths as well as the E-naira project which will also debut in October 2021.

“The NIFC will take advantage of our existing laws such as the BOFIA 2020, NEPZA and other CBN regulations to create a fully global investment and financial hub where monies, ideas, and technology will move freely without hindrance”, he added.

On efforts of the CBN in creating a robust payment system through the digital currency, Emefiele said, “Our robust payment system has continued to evolve towards meeting the needs of households and businesses in Nigeria. Reflective of the confidence in our payment system, between 2015 and 2020, close to $500m worth of funds have been invested in firms run by Nigerian founders.

“Notwithstanding these gains, close to 36 percent of adult Nigerians do not have access to financial services. Improving access to finance for individuals and businesses through digital channels can help to improve financial inclusion, lower the cost of transactions, and increase the flow of credit to businesses.

“It is in this vein that the Central Bank of Nigeria is working to deploy a central bank digital currency, which would help in attaining our goals of fostering greater inclusion using digital channels, supporting cross border payments for businesses and firms as well as providing a reliable channel for remittances inflows into the country.

“When fully deployed, the eNaira will ensure that Nigerians in remote areas can conduct financial activities using their digital as well as feature phone devices.

Emefiele also noted the declining revenue in meeting the task of infrastructural development. According to him, the sharp drop in crude oil prices has created huge gaps in generating revenue to meet targeted infrastructural development.

The CBN governor said, alternative ways of funding critical infrastructural needs have been evolved through InfraCorp, to sustain the growth of the Nigerian economy.

He urged the banking and financial system to support growth in sectors with significant growth potential, in order to enhance the resilience of the Nigerian economy, in the face of external shocks.

He also canvassed strong financial support for Agricultural development.

“Another key area of focus that would help support stronger growth of our economy is the agriculture sector.

On efforts on economy, he said, “I am optimistic that by the end of the year, our economy will not only close the output gap brought about by the 2020 recession, but that we would end the year with an annual GDP growth of between 2.5 – 3.0 percent, up from -1.92 percent in 2020.

Sorry, the comment form is closed at this time.